Australia's commercial real estate (CRE) sector is rapidly transforming with the growing reliance on data analytics and automation. Investors, developers, brokers, and analysts now leverage real-time data to make smarter decisions, drive competitive advantage, and gain deep insights into market trends. With the help of scraping services for commercial real estate Australia, organizations can continuously collect, process, and analyze vast volumes of commercial property information from multiple online sources. These services redefine how stakeholders interact with property data, offering better clarity in market forecasting, pricing decisions, investment strategies, and competitor analysis.

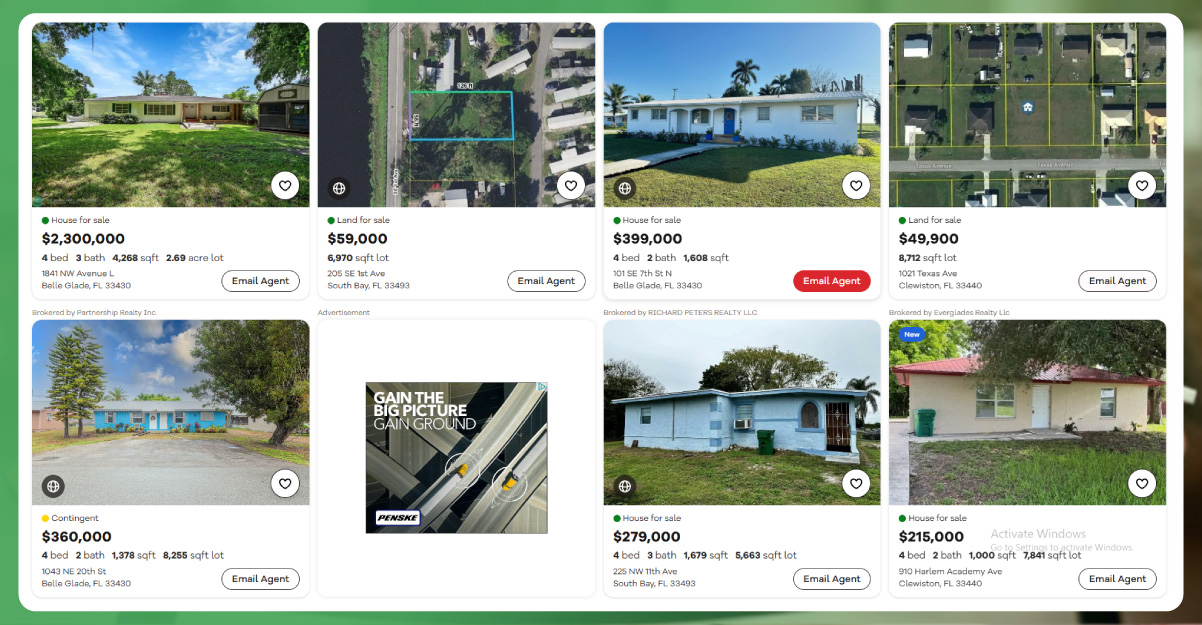

Real estate data has evolved beyond basic listing information to become a comprehensive business toolkit. Commercial properties—office spaces, retail locations, industrial warehouses, or mixed-use developments—hold valuable metadata. This includes pricing history, leasing patterns, availability trends, zoning laws, infrastructure proximity, demographics, etc. When stakeholders scrape Australian commercial real estate listings, they can compile large datasets from online listing portals, real estate agency websites, government registries, and property investment platforms.

This continuous extraction of information offers a competitive edge. Businesses can monitor trends such as rental yields, commercial vacancy rates, urban development zones, and shifting business districts. Analysts can build predictive models and visualize investment potentials across regions such as Sydney, Melbourne, Brisbane, Perth, and regional business hubs with this data.

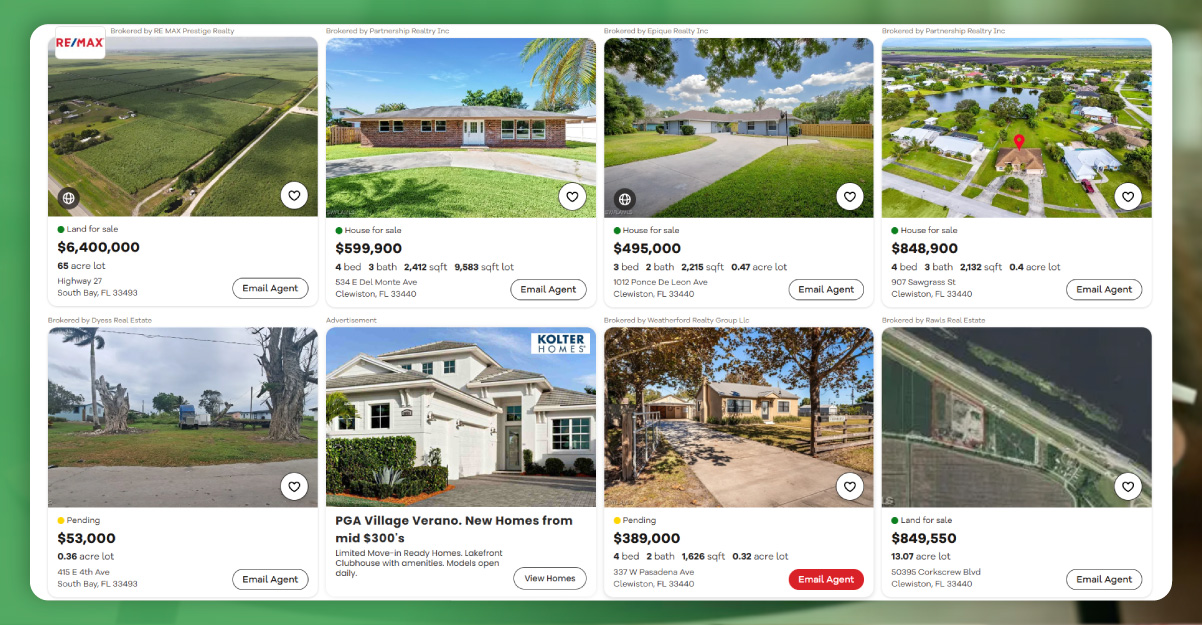

The commercial property market in Australia is dynamic and regionally diverse. Traditional data collection methods are often fragmented, static, and time-consuming. Automated web scraping allows real estate companies and investors to scale their data operations, gaining access to up-to-date and detailed insights in real-time. This is particularly important for institutional investors, construction companies, and property tech platforms that need to track hundreds of listings across different portals.

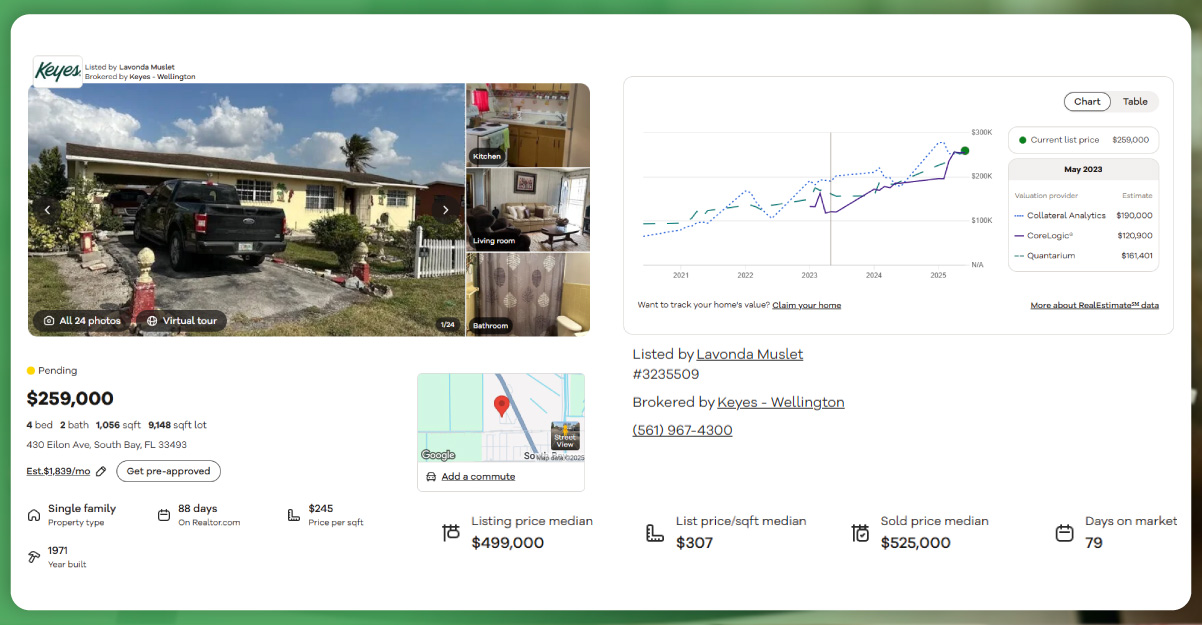

By deploying commercial real estate web scraping Australia services, businesses can aggregate data points, including property type, square footage, price per square meter, auction or lease terms, property age, environmental ratings, and ownership history. These datasets are then cleaned, normalized, and structured for easy integration with business intelligence (BI) tools, CRM systems, or custom dashboards.

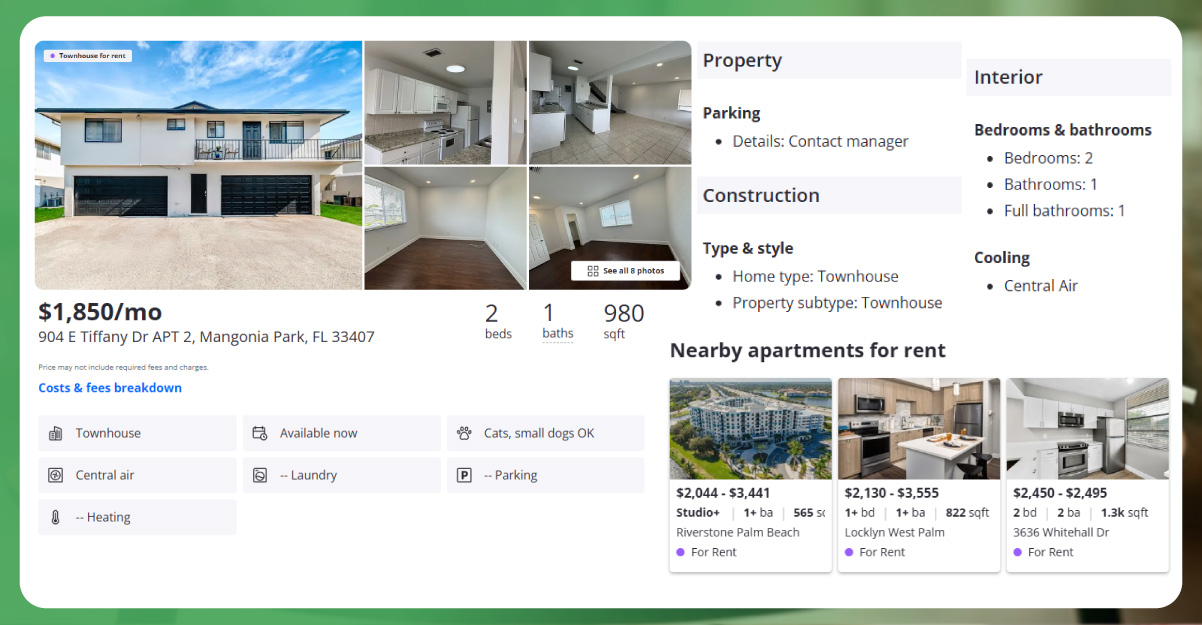

Different stakeholders have unique data needs. A property investment fund might focus on historical pricing trends and capital growth areas, while a leasing agent could be more concerned with active listings and new developments. This is where a tailored commercial real estate scraper for Australia becomes indispensable.

Such scrapers are configured to target specific fields and extract structured data from websites like realcommercial.com.au, domain.com.au, commercialrealestate.com.au, and regional council databases. Advanced scrapers can even detect updates to listings, track removed properties, or notify users about new properties that meet specific criteria. This granularity is essential for developers who want to evaluate competitor activity or benchmark against comparable properties. Real-time updates help leasing companies identify which spaces stay on the market longer and adjust pricing strategies accordingly. It also empowers urban planners to assess how infrastructure investments influence commercial land usage.

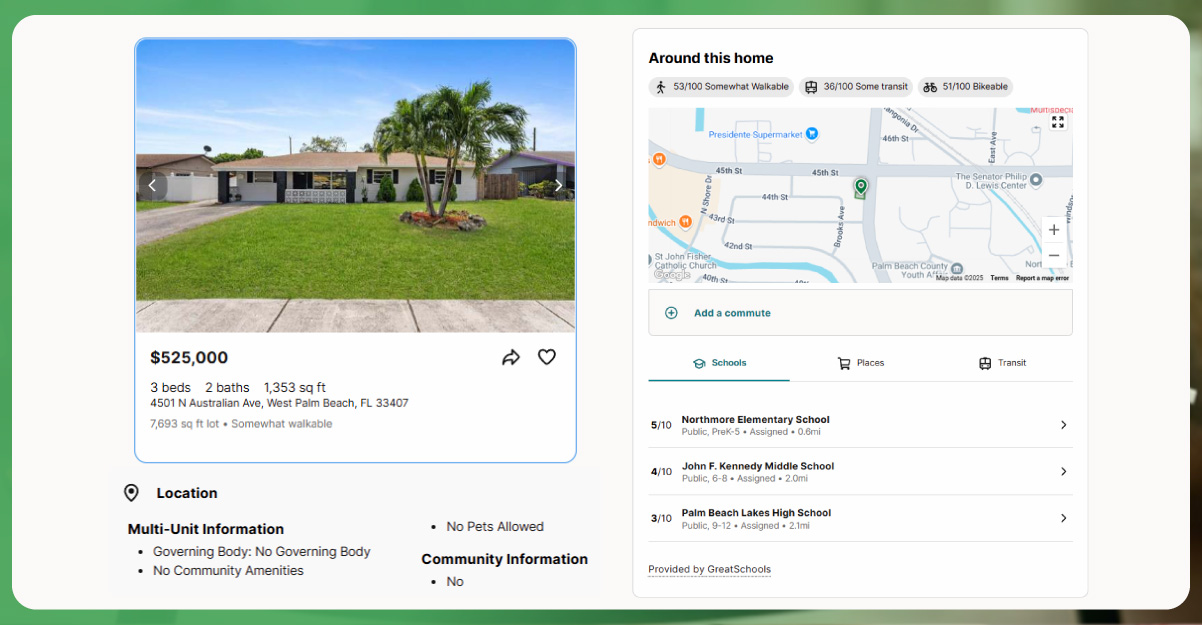

Data integrity and volume are the bedrock of any reliable analytics model. A well-curated commercial real estate dataset Australia includes multiple data layers—from listing details and historical pricing to zoning classifications, tenant profiles, and development permits. With access to such data, stakeholders can uncover hidden patterns and assess macroeconomic and micro-market trends.

These datasets are particularly crucial in Australia's fast-evolving urban landscape. With major infrastructure projects, population shifts, and business migrations between suburbs and CBDs, having a continuous stream of commercial property data can help forecast investment-ready locations. Retailers planning expansion strategies can use this data to optimize store locations, while logistics firms may track the availability and pricing of warehouse spaces along key freight corridors.

One primary use is to extract commercial property prices in Australia from a wide range of sources. Price monitoring helps businesses detect undervalued or overpriced assets, study market cycles, and identify premium vs. secondary property category trends. Scraped pricing data can reveal seasonality, changes in commercial property demand, effects of policy shifts (such as stamp duty adjustments), and even sentiment indicators based on price movement across regions. Combined with AI-powered analytics, this pricing intelligence helps developers and investment managers model ROI, compare yields, and assess location-specific risks.

Moreover, banks and financial institutions also rely on commercial pricing data to inform loan risk models, mortgage valuations, and portfolio diversification strategies.

Real estate developers are among the biggest beneficiaries of scraping technologies. From feasibility studies to land acquisition strategies, having a continuous supply of updated listings, zoning changes, and competitor developments gives them a strategic advantage. A well-structured Australian developers real estate dataset includes information on newly approved projects, DA (Development Application) statuses, proximity to amenities, transport access, and competing project timelines.

By integrating this data with geospatial and economic data, developers can simulate development scenarios and adjust their pricing, marketing, and delivery strategies accordingly. The result is a reduced risk profile, better buyer targeting, and optimized construction timelines based on market demand forecasts.

In today's high-velocity market, decision-making must be agile. Real estate data scraping services offer the infrastructure to support data freshness and responsiveness. Instead of relying on monthly reports or delayed market updates, companies can subscribe to real-time alerts or API-based feeds that deliver updates when a property status changes. This real-time capability supports use cases like live market dashboards, CRM alerts for agent follow-up, price tracker bots, and real-time competitor monitoring. For example, a commercial brokerage firm can see when a competitor lists a new property in their region and respond with targeted promotions or client notifications.

Unlock powerful real estate insights today—contact us to get started with your custom property data scraping solution.

While collecting data is essential, it's only part of the story. The actual value lies in transforming raw data into actionable insights. Through real estate data intelligence services , organizations can enrich scraped data with external sources like census demographics, business registries, transaction records, and infrastructure data. AI models can be applied to this enriched dataset to provide a deeper context.

For example, combining listing data with demographic movement can help predict where demand for co-working or retail hubs will increase. Merging property data with economic indicators like unemployment or consumer spending can help gauge investment risk in certain suburbs. Robust data intelligence directly results in the ability to forecast, map, and model commercial real estate performance.

As Australia's commercial property landscape becomes more competitive and data-driven, web scraping and automation will remain central to operational success. Whether identifying opportunities in secondary cities, tracking emerging industrial hubs, or benchmarking leasing rates, scraping tools offer scalable solutions for modern real estate professionals. Tools for web scraping property data reduce manual workloads and enable large-scale data analysis that was previously inaccessible. Companies building AI-powered platforms, investment heat maps, or automated valuation models rely on this scraped data to power their innovations

The shift from manual research to automated insights signifies a significant turning point in how the industry approaches decision-making. With real estate data scraping for real-time insights, companies no longer need to wait weeks or months for market feedback—they can act instantly based on live data. This advantage is particularly crucial for those aiming to stay ahead in Australia's rapidly changing commercial property market.

From data scientists and analysts to brokers and developers, the ability to tap into real estate property datasets is now a cornerstone of competitive strategy. As demand for accuracy, speed, and scale rises, scraping technologies will remain at the forefront of the commercial real estate revolution.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.